INDICATA White Paper highlights the impact of Covid-19 on Europe’s used car industry

Analysis reveals how used car industry is responding to different stages of Covid-19 including its impact on car dealers and OEMs

INDICATA, the global leader in used vehicle pricing and market analysis has released a new free-to-download White Paper which looks at the short, medium, and long-term effects of Covid-19 on the European used car industry, particularly dealer groups and OEMs.

INDICATA analyses nine million used vehicle advertisements across Europe each day which enables it to gain a strong view of demand and retail market pricing by country which gives vendors the earliest warning of market issues such as Covid-19 or opportunities.

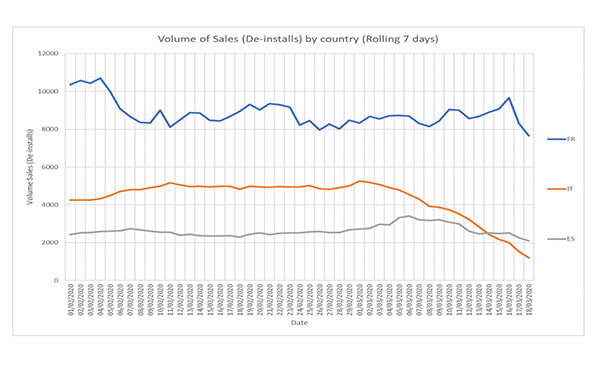

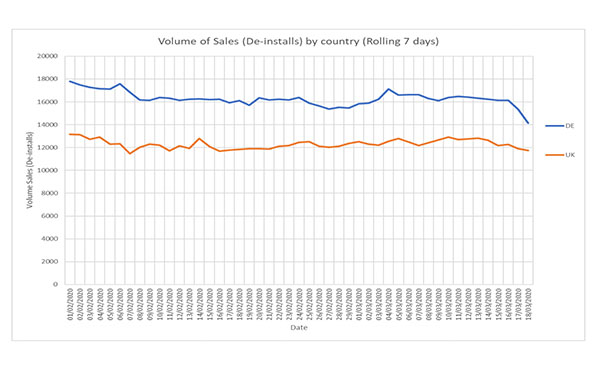

By analysing the number of vehicle adverts removed from the internet, INDICATA data assessed consumer used vehicle sales activity. Northern Europe saw a sales fall of 21.5% between 11 and 18 March, while southern Europe, including Italy fell by 44% during the same period.

The White Paper can be downloaded for free at www.indicata.co.uk/corona

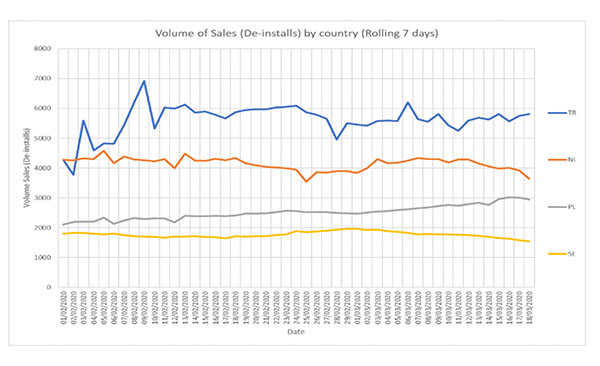

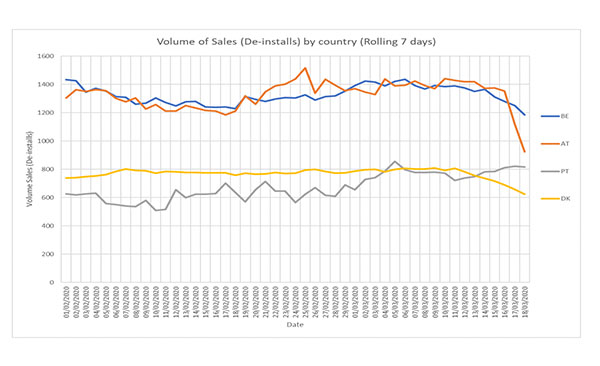

Here are some of the market changes by country in more detail:

^INDICATA data shows used car sales rates in Italy, France and Spain. Italy’s dramatic fall in sales is clear, Spain’s volumes are beginning to ease, and the French market has started to fall.

^Comparing the UK and Germany, data shows the former is showing a small market fall, while there is a more visible downward step change in German sales volumes.

^The variances between medium sized countries shows some impact in the Netherlands and Sweden, while Poland and Turkey are yet to be impacted due to having lower infection rates.

^ Looking at Europe’s smaller countries there is a marked difference between markets. Austria closed its border with Italy on 11 March and the impact has been instant. Denmark and Belgium have implemented strong sanctions and the effects are showing. Portugal declared a state of emergency on 19 March and we can expect car sales to fall quickly.

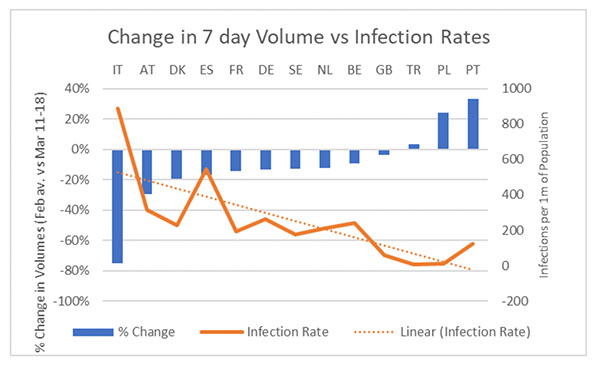

^Our data shows the correlation between infection rates and the fall in used car sales between 11-18 March versus the same period in February. We have compared this to infection rates per 1m of population. Countries like Poland and Turkey, with low infection rates have been least affected. As the virus progresses so re-marketers will need to know the country-by-country market trends to identify the most effective sales channels.

Andy Shields, INDICATA’s global business unit director and White Paper author said: “The relationship between the increase in the number of people with Covid-19 and the measures each individual government introduces to fight the pandemic is already having a detrimental impact on European dealers and OEMs.

“Countries will have different challenges at different times and it’s all about equipping companies with the right data to help assist them to make fast decisions, which is where our pricing insights come into their own. We look forward to bringing you regular country data in the near future,” he added.

The White Paper also looks at how the last recession played out for both the new and used car markets across Europe and how those same trends may repeat in a world dominated by Covid-19. In addition, the paper explores how China is getting control of infection rates, and how this may provide learnings for Europe.

Andy Shields, INDICATA’s global business unit director has looked into Covid-19’s potential impact on dealers and OEMs by using live market data and historical insights into previous recessions.

Dealers and Dealer Groups

Dealers will face significant challenges as their new vehicle volumes come under real pressure and in a hostile market, stock turn is the most powerful weapon for defending profitability.

In a market where used prices are falling and sales rates slowing, it will be vital for dealers to focus heavily on ensuring their pricing policies do not allow any vehicle to age and become uncompetitive in price. Buying the right stock, and constantly repricing it to the market will be the key to success.

Covid-19 will reduce consumer showroom traffic and the few buying customers will go even more online. Increasing the number of effective web leads will be key to starting the sales process off. Dealers implementing online trade-in valuation tools can double web effectiveness.

OEMs and OEM Banks

OEMs and OEM banks face different challenges as they are hit with larger than expected volumes of rental de-fleets. Making a quick decision to exit vehicles before social distancing measures impact used prices will require bold actions.

OEMs who have traditionally tried to sell their used car stock solely though their franchised dealers may find increased volumes and lower network capacity a challenge. Fragmenting volumes into a wide range of non-franchised operators will protect RVs far better than bulk deals with large groups.

OEM banks will need to identify new routes to market the increasing numbers of returned vehicles including repossessions, where vehicle history and maintenance are less well known and with RV underwritten products. Increased residual value exposure dictates two courses of action:

- OEMs and their banks should identify agreements with either positive or near positive equity and target customers to change vehicles quickly, to help minimise the RV risk.

- For returning vehicles new, potentially non-franchise disposal routes may be needed.

Go to www.indicata.co.uk/corona to download the 18-page White Paper in full.