INDICATA launches free Market Watch data to help companies manage the impact of Covid-19 on their used car assets

INDICATA, part of the Autorola Group has announced the launch of Market Watch, a two-tier free information source for remarketing professionals that provides a competitive edge when making used vehicle decisions.

Market Watch features used market volumes and pricing data in 13 individual countries, including the United Kingdom by analysing nine million used vehicle advertisements across Europe each day. It provides ongoing data analysis and trends at both macro and micro level that generate insights that are crucial when tackling issues such as the current Covid-19 pandemic.

Market Watch is available as a regular PDF hosted on individual INDICATA country websites, while access to a more comprehensive web-based market reporting tool is available to senior decision makers in the leasing, rental, OEM and dealer group sectors.

Market Watch has published its most recent data analysis following last week’s INDICATA Covid-19 White Paper. It focuses on the impact on used car sales across 13 European markets during March and impact on used prices during March and April.

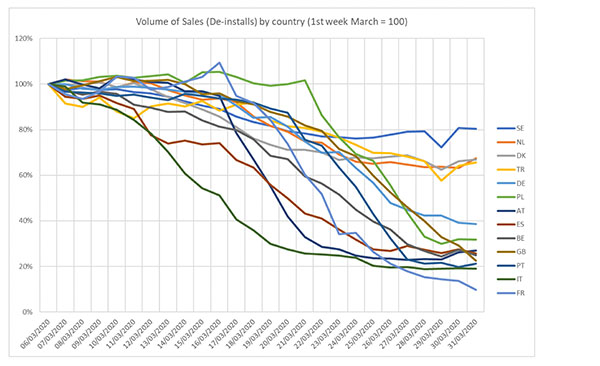

Used car sales volumes by European country 6-31 March 2020

Our graph shows the stark difference between the markets in full lockdown, and those with some residual used car trading. Indexing from week one in March, the resilience of Sweden retaining 80% of its used car volumes and Turkey, Netherlands and Denmark (retaining two thirds of its volumes) contrasts with the lockdown countries where sales have dramatically fallen towards zero.

Source: INDICATA Market Watch

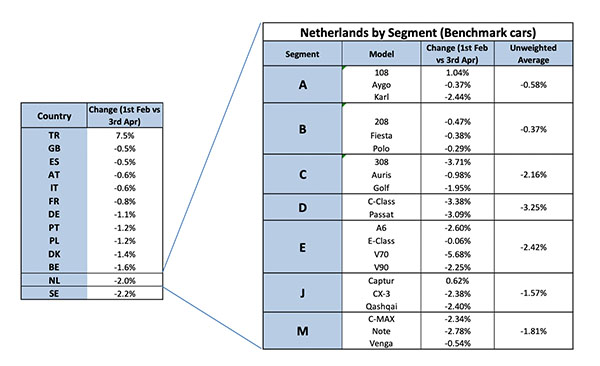

Used car retail market price changes 1 February – 3 April 2020

Our diagram shows how prices have changed based on Indicata’s Market Watch benchmark cars basket between 1 February and 3 April. Expanding the Netherlands used car pricing into segments reinforces the power of Market Watch at a micro level.

Source: INDICATA Market Watch

The first interesting observation is the lack of overall price movement in some countries and a correlation with the introduction in social distancing.

Looking at UK, Spain, Austria, Italy and France, where they went into lockdown with the hardest or fastest measures, dealers had minimal time to react before closure and experienced the fewest number of price changes. Conversely, Denmark, Belgium, Netherlands and Sweden progressed more slowly into social distancing and their fall in volumes were either slower or less pronounced than other countries. As a result, their dealers had time to react by dropping prices.

Looking at individual countries, small cars in the Netherlands sustained values initially better than larger vehicles, both from a € value and a percentage, typical of a market slide.

Turkey at 7.5% may appear to show remarkable growth, however, if we overlaid recent market growth rates, we would have expected a 10% rise. The move to used cars as ‘a safe asset’ fuelled by the lack of new cars and relatively cheap consumer finance has potentially created a market price bubble.

“Market Watch gives further support to the used car industry to help make sense of how to manage the impact of Covid-19. Our PDF and web portal provide used car decision makers with the best real time data to build both a short term and long-term strategy to efficiently manage used car supply and demand,” explained Andy Shields, INDICATA’s global business unit director.

Go to www.indicata.com/corona to sign up to your free PDF or web-based data feed.